Max India to acquire 20 per cent shares at Rs 85 per unit

ANI

15 Sep 2020, 18:07 GMT+10

New Delhi [India], Sep 15 (ANI): Max India said on Tuesday it will reward its shareholders by acquiring up to 20 per cent outstanding shares at Rs 85 per share under its capital reduction programme.

Max India, which recently relisted on the Indian bourses on August 28 after a demerger process, has a treasury corpus of over Rs 400 crore created primarily from divestment proceeds of its erstwhile subsidiary Max Bupa.

It intends to utilise up to Rs 92 crore from this corpus for the capital reduction process while the balance of Rs 300 crore plus will be used for growth and other operational expenses.

The cash out through a capital reduction process translates to a 37 per cent premium to this price.

Mohit Talwar, Vice Chairman of Max Group and Managing Director, said the company had expressed intent to reward its shareholders at the time it divested the health insurance business Max Bupa.

"This capital reduction process is a move towards that intent even though capital conservation has become important after the onset of COVID-19 induced economic slowdown. We will still have sufficient growth capital for growth and other expenses."The board of directors approved the capital reduction exercise earlier today. The proposal will also need to be approved by a special resolution of public shareholders.

It will additionally need regulatory approvals including from stock market regulator and National Company Law Tribunal in Mumbai over the next six to eight months.

After the capital reduction, Max India's outstanding shares will decrease by up to 20 per cent from 5.38 crore to 4.3 crore.

The Max Group recorded consolidated revenues of Rs 19,800 crore in FY20. It has a total customer base of 40 lakh, around 400 offices spread across India and an employee strength of more than 16,000. (ANI) Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Breaking Property News news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Breaking Property News.

More InformationBusiness

SectionBitcoin soars to a record on Trump policies, institutional demand

NEW YORK CITY, New York: Bitcoin surged to a new all-time high this week, buoyed by growing institutional interest and a wave of pro-crypto...

Huawei eyes new buyers for AI chips amid U.S. export curbs

SHENZHEN, China: As global chip competition intensifies, Huawei Technologies is exploring new markets in the Middle East and Southeast...

U.S. food prices at risk as Brazil tariff hits key imports

LONDON/NEW YORK CITY: American grocery bills may be headed higher as coffee and orange juice prices face upward pressure from new tariffs...

WK Kellogg sold to Ferrero as food giants chase shelf power

BATTLE CREEK, Michigan: In a major consolidation of iconic food brands, WK Kellogg has agreed to be acquired by the owner of Ferrero...

Filmmaker joins biotech effort to bring back extinct giant bird

WASHINGTON, D.C.: Filmmaker Peter Jackson's lifelong fascination with the extinct giant New Zealand flightless bird called the moa...

India seeks WTO nod for retaliatory tariffs on US

NEW DELHI, India: India has submitted a revised proposal to the World Trade Organization (WTO) in Geneva to implement retaliatory tariffs...

Construction

SectionMatt Fleming- Addressing the objectively wrong defenders of Marxism

Matt Fleming- Addressing the objectively wrong defenders of Marxism

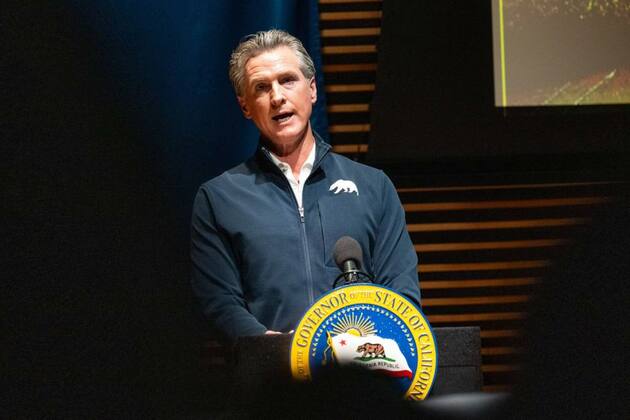

Gavin Newsoms California- A cautionary tale, not a national blueprint

Gavin Newsoms California- A cautionary tale, not a national blueprint

By excluding gay parents, the right risks losing the family argument

By excluding gay parents, the right risks losing the family argument

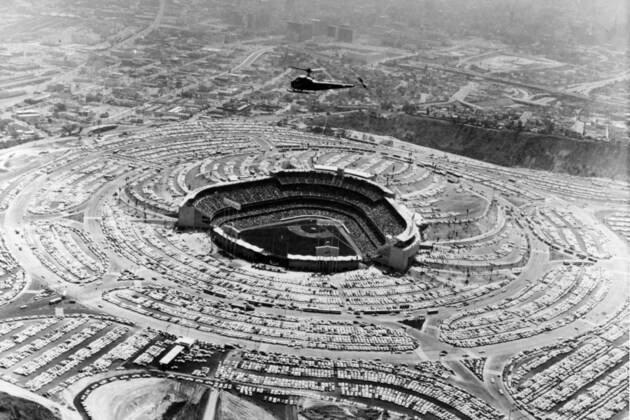

Bulldozed- How eminent domain erased working-class neighborhoods

Bulldozed- How eminent domain erased working-class neighborhoods

Douglas Schoen- New York City moves left, California moves right

Douglas Schoen- New York City moves left, California moves right