Asia markets mixed, dollar rises as Biden's pledges huge stimulus

News24

11 Jan 2021, 14:12 GMT+10

Asian markets were mixed Monday as traders struggled to track another record performance on Wall Street, though investors remain broadly upbeat on the prospect of a further massive stimulus for the US economy, with President-elect Joe Biden calling for a spending spree in the trillions of dollars.

With vaccines being rolled out around the world and key risk events including the US election, Georgia senate runoffs and Brexit now out of the way, observers said focus is now on the expected global recovery from last year's economic catastrophe.

The need for more financial help for the world's top economy was laid out Friday with data showing 140 000 people lost their jobs in December - the first fall since April - as virus infections and deaths surged across the country.

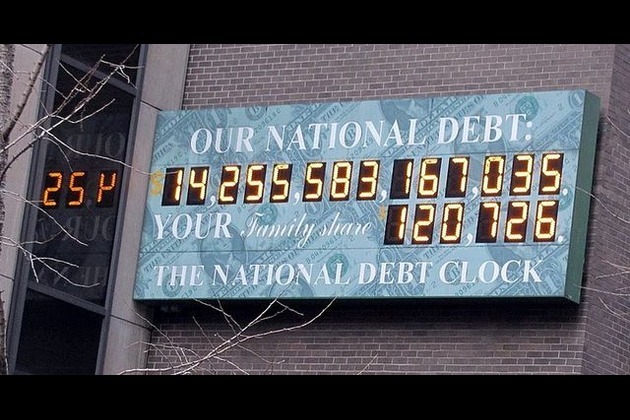

Biden, who will be sworn in as president on January 20, said he would press for a new rescue package that includes $2,000 direct payments to taxpayers and help for small businesses.

"The price tag will be high," he warned as he promised to lay out his proposals Thursday. "It will be in the trillions of dollars."

He added: "If we don't act now, things are going to get much worse and harder to get out of a hole later."

Investors welcomed the prospect of another spending splurge that will provide a huge boost to the economy, coupled with Federal Reserve financial support and record low rates for the foreseeable future.

The dollar extended gains across the board, and was sitting at a three-week peak against the yen.

Covid's 'nasty cloud'

Wall Street's three main indices all finished last week at all-time highs, but Asia struggled to push on.

Hong Kong, Mumbai, Taipei, Manila, Jakarta and Bangkok were all up but Shanghai, Sydney, Singapore and Wellington fell, while Seoul was also lower despite a rally in market heavyweight Samsung that was fuelled by reports it is in talks with US giant Intel over making some of its best chips.

While the broad consensus is for a strong run in equities this year, there is a feeling that the latest rally may be petering out.

"After being bullish for several months, we are definitely becoming more cautious on the stock market up at these levels," said Matt Maley, at Miller Tabak + Co., adding that most of the surge in the S&P 500 from March its March trough is "behind us".

Axi strategist Stephen Innes added that fears about the virus, which continues to wreak havoc around the world and force governments to impose new lockdowns, remained the main stumbling block.

"Covid concerns continue to hang like a nasty cloud over the market, and given a great deal of optimism in stocks and oil is linked to the rollout of vaccines, investors are sitting with fingers and legs crossed that there won't be any negative news flows on this front (which) would prompt a sharp negative market reaction," he said in a commentary.

He also pointed to ongoing China-US tensions after the White House said it would end self-imposed restrictions on official contacts with Taiwan, a move likely to irk Beijing.

The change will add to complications for Biden as he assumes the presidency, with any move to reverse the decision opening him up to accusations of being soft on China.

Oil prices dropped but remain near 10-month highs, supported by hopes for more stimulus and following Saudi Arabia's announcement last week that it plans to slash output by a million barrels a month in February and March.

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Breaking Property News news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Breaking Property News.

More InformationBusiness

SectionSaudi Aramco plans asset sales to raise billions, say sources

DUBAI, U.A.E.: Saudi Aramco is exploring asset sales as part of a broader push to unlock capital, with gas-fired power plants among...

Russia among 4 systemic risk countries for Italian banks

MILAN, Italy: Italian regulators have flagged four non-EU countries—including Russia—as carrying systemic financial risk for domestic...

US debt limit raised, but spending bill fuels fiscal concerns

NEW YORK CITY, New York: With just weeks to spare before a potential government default, U.S. lawmakers passed a sweeping tax and spending...

Shein hit with 40 million euro fine in France over deceptive discounts

PARIS, France: Fast-fashion giant Shein has been fined 40 million euros by France's antitrust authority over deceptive discount practices...

Meta hires SSI CEO Gross as AI race intensifies among tech giants

PALO ALTO/TEL AVIV: The battle for top AI talent has claimed another high-profile casualty—this time at Safe Superintelligence (SSI),...

Engine defect prompts Nissan to recall over 443,000 vehicles

FRANKLIN, Tennessee: Hundreds of thousands of Nissan and Infiniti vehicles are being recalled across the United States due to a potential...

Construction

SectionChinese contractors boost Kenya's construction sector through tech transfer, says regulator

NAIROBI, July 4 (Xinhua) -- Chinese contractors are helping advance Kenya's construction sector by transferring technologies, the industry...

Germany's housing prices rebound sharply in Q1 after 2-year slump

BERLIN, July 1 (Xinhua) -- Germany's housing market showed strong signs of recovery in the first quarter of 2025, with residential...

Riverside sheriffs office disses juries and county taxpayers

Riverside sheriffs office disses juries and county taxpayers

Olson- Erin Murphy wades through grief with lessons learned from Melissa Hortman

Olson- Erin Murphy wades through grief with lessons learned from Melissa Hortman

Counterpoint- What No Kings protests are actually about

Counterpoint- What No Kings protests are actually about