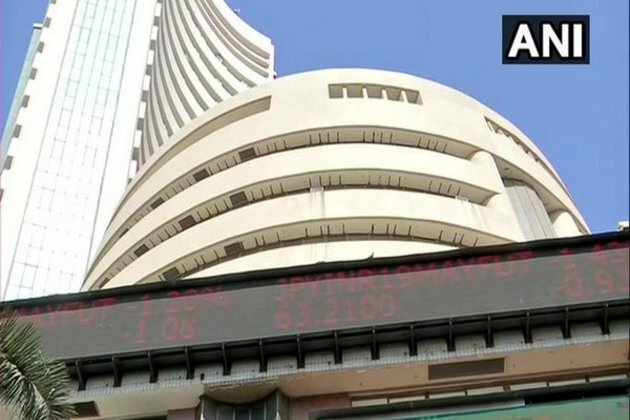

Indian stocks decline for 4th straight day; US Fed meet in focus

ANI

19 Sep 2022, 10:25 GMT+10

Mumbai (Maharashtra) [India], September 19 (ANI): Indian stocks extended their losses for the fourth straight day to start a fresh week in the red.

At the time of writing this report, Sensex and Nifty were trading 0.1 per cent lower each. Among the Nifty 50 companies, 25 declined and the rest 25 advanced this morning, National Stock Exchange data showed.

The benchmark indices - Sensex and Nifty - settled 1.8-1.9 per cent lower on Friday.

Market participants are not aggressively participating and are largely shying away from making large bets, especially on concerns of aggressive global monetary policy tightening by various central banks to avert recessionary fears.

Three of the largest five economies will hold their central bank meetings during this week, including the US, Japan and the UK. Investors will keep a close on the monetary policy stances of these economies.

Consumer inflation in the US though declined marginally in August to 8.3 per cent from 8.5 per cent in July but is way above the 2 per cent goal. Several senior officials in the US central bank Federal Reserve recently said that another interest rate hike is imminent during the two-day monetary policy meeting that will start on TuesdayInflation in the UK is currently at 9.9 per cent.

These elevated inflation numbers give clear signs that the respective central bank will raise interest rates to contain price rises. Raising interest rates is a monetary policy instrument that typically helps suppress demand in the economy, thereby helping the inflation rate decline.

Inflation, both retail and wholesale, is high in India too, which may necessitate further interest rate hikes by the Reserve Bank of India.

As per schedule, the next three-day monetary policy meeting will be held during September 28-30.

"The market is likely to take a decisive trend only after the Fed policy announcement on 21st September. The market expects the Fed to raise rates by 75 bp and reiterate its hawkish stance. But since the market is going into the event with light positions and no positive expectations any positive data or comment may act as a trigger for a relief rally after the Fed announcement," said V K Vijayakumar, Chief Investment Strategist at Geojit Financial Services. (ANI) Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Breaking Property News news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Breaking Property News.

More InformationBusiness

SectionMusk’s X loses CEO Linda Yaccarino amid AI backlash, ad woes

BASTROP, Texas: In a surprising turn at Elon Musk's X platform, CEO Linda Yaccarino announced she is stepping down, just months after...

Ex-UK PM Sunak takes advisory role at Goldman Sachs

NEW YORK CITY, New York: Former British prime minister Rishi Sunak will return to Goldman Sachs in an advisory role, the Wall Street...

Gold ETF inflows hit 5-year high as tariffs drive safe-haven bets

LONDON, U.K.: Physically backed gold exchange-traded funds recorded their most significant semi-annual inflow since the first half...

PwC: Copper shortages may disrupt 32 percent of chip output by 2035

AMSTERDAM, Netherlands: Some 32 percent of global semiconductor production could face climate change-related copper supply disruptions...

U.S. stocks recover after Trump-tariffs-induced slump

NEW YORK, New York - U.S. stocks rebounded Tuesday with all the major indices gaining ground. Markets in the UK, Europe and Canada...

Stocks slide as Trump unveils 25% tariffs on Japan, S. Korea

NEW YORK CITY, New York: Financial markets kicked off the week on a cautious note as President Donald Trump rolled out a fresh round...

Construction

SectionNurse Admits Amputating Man's Leg Without Permission UK Crime

Nurse Admits Amputating Man's Leg Without Permission UK Crime

North Carolina Sheriff Retires Amid Sexual Misconduct Charges Latest News

North Carolina Sheriff Retires Amid Sexual Misconduct Charges Latest News

Detroit-Area McDonald's Employee Kills Co-Worker After Argument Latest News

Detroit-Area McDonald's Employee Kills Co-Worker After Argument Latest News

Ex-NBA Player Ben McLemore Sentenced To Prison For Rape Latest News

Ex-NBA Player Ben McLemore Sentenced To Prison For Rape Latest News

Too far? Sunrise weatherman Sam Mac shocks co-host Natalie Barr in a VERY awkward exchange

Too far? Sunrise weatherman Sam Mac shocks co-host Natalie Barr in a VERY awkward exchange

UK Housebuilders Offer 100m To Settle CMA Probe Into Information Sharing

UK Housebuilders Offer 100m To Settle CMA Probe Into Information Sharing